(This section is a Summary of Material Modifications [SMM] to the Summary Plan Description [SPD].)

The following changes to current Alcatel-Lucent benefits coverage under the Alcatel-Lucent health and welfare benefits plan (the “Plan”) will take effect on January 1, 2015.

Other Changes May Apply to HMO Coverage

Unless noted, the changes in this guide do not apply to Health Maintenance Organization (HMO) options. You will need to check the YBR website during the annual open enrollment period or contact the carriers of those options directly for their 2015 plan changes. Carrier contact information is located on the back of your HMO ID card and in the Benefits At-a-Glance and Resource Contact Information booklet.

Certain former Lucent employees who retired on or after March 1, 1990 (and their survivors) are currently eligible for a Company subsidy toward their Alcatel-Lucent–provided medical coverage. Effective January 1, 2015, this subsidy will be eliminated and will no longer be available.

As a reminder, healthcare reform offers an alternate source for health insurance: the health insurance marketplace that is available in your area. In fact, many retirees not eligible for Medicare (and their survivors who are not eligible for Medicare) may find marketplace coverage to be more affordable than medical coverage offered through the Alcatel-Lucent Plan, even if the Company subsidy were still available. See “Healthcare Reform Update for 2015” below for more information on marketplace coverage.

If you are affected, you can expect your premiums to increase beginning with your 2015 coverage. Medical coverage premiums for 2015 will be available on the YBR website when the online-only enrollment period begins on Monday, September 22, at 9:00 a.m. ET. Note that Alcatel-Lucent Benefits Center representatives will be unable to answer any questions about the 2015 rates until Monday, October 6, at 9:00 a.m., ET.

Alcatel-Lucent is committed to keeping the cost of your prescription drugs down while providing you with the coverage you need. With this goal in mind, Express Scripts uses a set of coverage management programs to determine how the Prescription Drug Program will cover certain prescription drugs.

Effective August 15, 2014, additional coverage management programs were added. You will be notified by Express Scripts if you are impacted by any of the new programs.

Effective January 1, 2015, Univera HMO will not be available. If you are currently enrolled in this HMO, you will need to choose another medical option for 2015 or you will be enrolled in default coverage. For more information about default coverage, see “Check Your Default Coverage.”

Back to topDue to adjustments made by the Centers for Medicare & Medicaid Services (CMS), there will be some changes to your drug coverage for 2015:

The chart below highlights the differences for 2015.

| 2014 | 2015 | |

|---|---|---|

| Deductible amount | $310 | $320 |

| “Donut hole” | After total payments (including copayments and deductible, plus the Plan’s cost for the drugs) reach $2,850, you pay 72% of the cost of generic drugs and about 47.5% of the cost of most brand-name drugs, up to $4,550. | After total payments (including copayments and deductible, plus the Plan’s cost for the drugs) reach $2,960, you pay 65% of the cost of generic drugs and about 45% of the cost of most brand-name drugs, up to $4,700. |

| Cost-sharing outside of the “donut hole” | You pay the greater of 5% of the cost or a copayment of $2.55 for generics/$6.35 for brand-name drugs, per prescription, for the remainder of the year. | You pay the greater of 5% of the cost or a copayment of $2.65 for generics/$6.60 for brand-name drugs, per prescription, for the remainder of the year. |

(While you are in the “donut hole,” either the Plan pays the rest of the costs for covered drugs, or they are paid for by drug manufacturers’ discounts.)

For more information about how the Plan works, see the Benefits At-a-Glance and Resource Contact Information booklet.

Back to topEffective January 1, 2015, you can take advantage of a new fitness benefit if you are enrolled in the UnitedHealthcare Group Medicare Advantage (PPO) plan.

SilverSneakers® is a fitness program for people at any level of fitness. It is available at no cost to you. The program includes a basic fitness center membership in any of more than 11,000 participating fitness centers nationwide.

If the nearest participating location is 15 or more miles from your home, you can register for the SilverSneakers Steps program. This personalized program provides tools, resources and information to help you track and increase your daily activity.

You will receive additional information from UnitedHealthcare.

Review the YBR website during the annual open enrollment period for your 2015 premium costs.

Last year, there was a 28 percent reduction in the number of requests for printed Annual Open Enrollment Kits. Thank you for your continued efforts in helping us to go green!

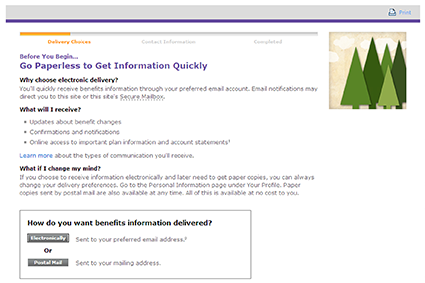

As part of our corporate commitment to the environment, we will continue to provide more of your benefits information online instead of in print. So if you have not yet signed up to receive communications from the Alcatel-Lucent Benefits Center electronically, please take a few moments to do so now.

You do not need to wait until annual open enrollment to make this election. Just log on to the YBR website anytime. Select “Your Profile” and click “Personal Information.” Follow the steps to provide your preferred email address and update your preferred method of delivery.

When you log on to the YBR website, click the “Go Paperless” tile under “Highlights for You.” Follow the prompts to choose your preferred method of delivery (electronically or postal mail) and verify your contact information.

See “Using YBR” for more information.

The Affordable Care Act (healthcare reform) continues to bring big changes to the U.S. healthcare system.

As a reminder, in accordance with the Affordable Care Act, if you are not eligible for Medicare, you have an alternate source from which to purchase health insurance: the health insurance marketplace that is available in your area.

You should compare your Alcatel-Lucent health coverage with the coverage available through the marketplace. Many participants not eligible for Medicare may find marketplace coverage to be more affordable than medical coverage offered through the Alcatel-Lucent Plan.

If you enroll in Alcatel-Lucent health coverage during annual open enrollment and later decide to enroll in marketplace coverage for 2015 during the marketplace open enrollment period (November 15, 2014 – February 15, 2015), you can drop your Alcatel-Lucent coverage. But keep in mind: If you drop Alcatel-Lucent coverage, Alcatel-Lucent medical and prescription drug coverage for all members of your family will end, including those eligible for Medicare.

You must call the Alcatel-Lucent Benefits Center by December 31, 2014, to drop your Alcatel-Lucent coverage that would be effective as of January 1, 2015. If you call after December 31, your coverage will be dropped as of the first of the month following the date you call. (Note that the effective date that your coverage will be dropped may differ if your medical option requires a disenrollment form.)

The effective date for marketplace coverage will depend on when it is purchased, as follows:

For the most current information about the health coverage available through the marketplace, please visit HealthCare.gov. The Alcatel-Lucent Benefits Center cannot answer any questions about marketplace coverage.

Note: If you enroll in health coverage through the marketplace instead of through Alcatel-Lucent, you may not be able to enroll in Alcatel-Lucent coverage in the future. Please see the “Notes” and refer to the SPD for information on when you can make changes to your coverage.

The Affordable Care Act does not permit persons who are eligible for Medicare to buy health insurance through the health insurance marketplace. If you are eligible for Medicare and do not want to enroll for Alcatel-Lucent coverage, you may buy Medicare supplemental insurance on your own (for example, from an insurance company, broker or other resource that offers Medicare supplement plans).

Back to top1Includes COBRA participants and survivors in the Family Security Program (FSP).